Get the free colorado real transfer declaration form

Get, Create, Make and Sign

How to edit colorado real transfer declaration online

How to fill out colorado real transfer declaration

How to fill out colorado real transfer declaration:

Who needs Colorado real transfer declaration:

Video instructions and help with filling out and completing colorado real transfer declaration

Instructions and Help about colorado transfer declaration form

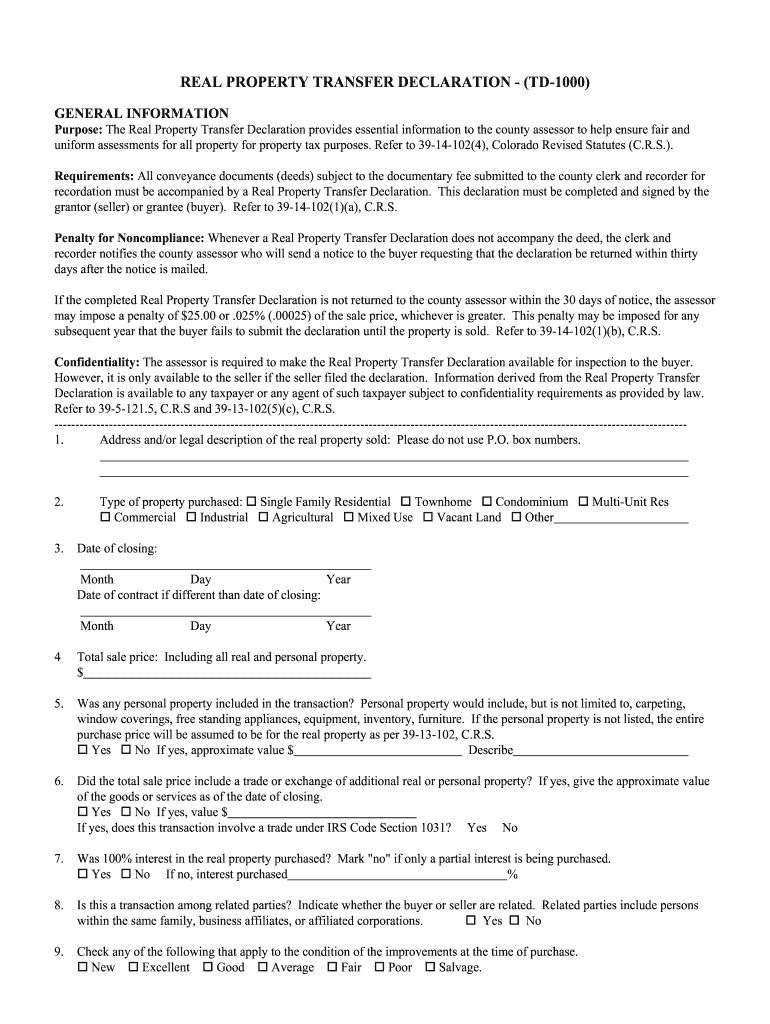

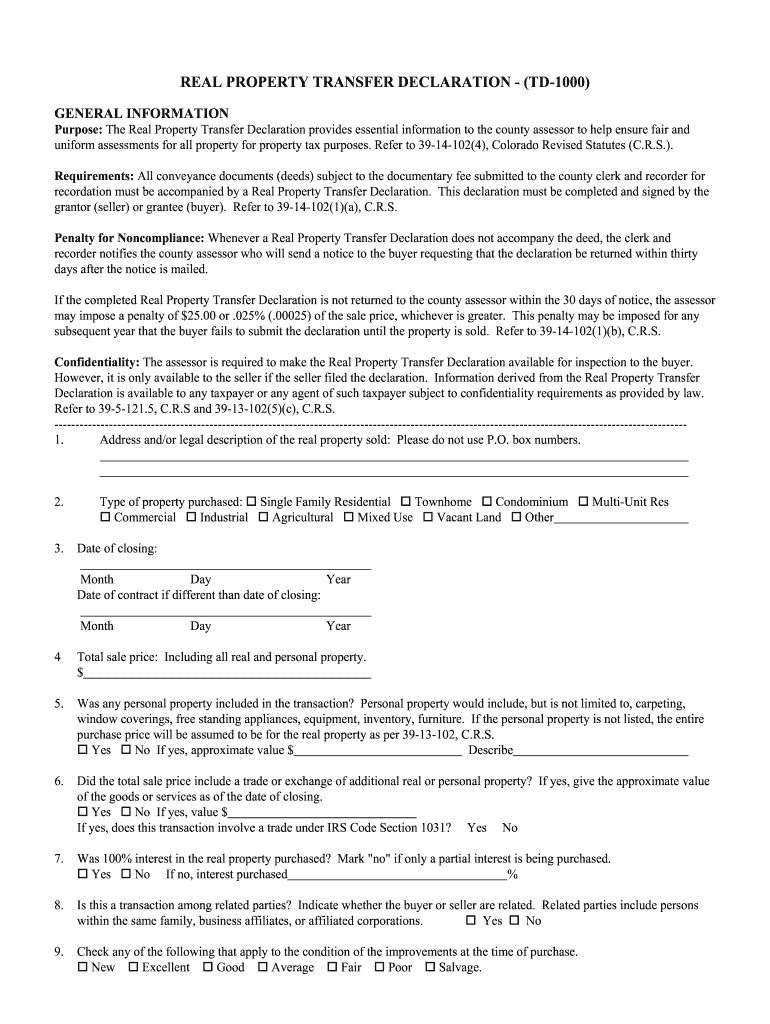

Hi this is Jim Crenshaw, and I'm going to discuss the Real Property Transfer declaration so what this is a forum that's filled out by the buyer at closing and delivered to the county tax assessor from the title company the purpose of this forum is to provide additional information to the county tax assessor so what they're trying to do the county tax assessor establishes a property valuation for your property so one of the main factors that they look at is sales price but sales price doesn't always tell the entire story and so the world property transfer declaration is additional information provided to the county tax assessor to help them establish the property valuation there is a small penalty if this isn't filled out but if you're closing with a title company this form will be delivered to the county tax assessor after closing there are some questions that a buyer needs to be prepared to answer when filling this out at closing I've included a link to a guide to answer all the questions in this form, but I'm just going to discuss three of the most common questions that a buyer needs to be prepared to answer, so this form asks whether there was personal property transferred with the home and if so the buyer needs to assign an approximate value and describe those items of personal property, so the idea behind this is you're providing additional information to the county tax assessor related to personal property and a quick example would be a home that selling fully furnished with a let's say they're including a car that would be very important for the county tax assessor to realize when they're looking at the sales price that it include maybe 50 60 70 thousand dollars worth of personal property another item is the condition of the improvement, so the improvements are considered to be in the home garage improvements to the real property, and you would as a buyer determine what the condition is of these improvements and then thirdly would be financing primarily number 13 which asks that there's seller assistance if there are seller concessions so what this would help the county tax assessor in the appraisal process would be if there was say ten thousand dollars worth of concessions paid from the seller to the buyer this would be important information for the appraisal to review when determining property value there's a link down below I think that's good it's provides a couple of different things a guide to filling out the other questions and then also the actual form itself so if you want to review this form prior to closing there's also a link down there and then thirdly there is a link from the Douglas County website in determining real property versus personal property in a list those items that they consider to be personal property and those items that should be considered real property I hope this helps you if you have questions please contact me through the website and appreciate your time

Fill you td 1000 online : Try Risk Free

People Also Ask about colorado real transfer declaration

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your colorado real transfer declaration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.